President Signs $2 Trillion Emergency Relief Measure to Assist Small Businesses

On March 27, 2020, President Trump signed the Coronavirus Aid, Relief and Economic Security (“CARES”) Act designed to assist businesses affected by the COVID-19 pandemic. Among other provisions, the CARES Act provides hundreds of billions of dollars to small business and individuals in the form of grants, tax credits and loans.

Significantly, the CARES Act creates a new Paycheck Protection Program, which provides for government-backed forgivable loans to small businesses with 500 or fewer employees. The loans, which are available through June 30, 2020, are intended to assist small businesses with funding to meet payroll and other operating expenses, including, rent, utility payments, and interest on mortgages on real or personal property.

Who is Eligible for the Paycheck Protection Program Loan?

Borrowers with 500 or fewer employees, including corporations, partnerships, independent contractors, sole proprietorship, certain non-profits and tribal businesses, may be eligible for a Paycheck Protection Program loan. Special rules apply for businesses in certain industries, such as restaurant, food-service and hotels - which may be permitted to calculate employees by physical location. The Small Business Administration (“SBA”) has the authority to increase the 500 employee limit on an industry by industry basis.

When are the Paycheck Protection Program Loans Available?

The applications for Paycheck Protection Program loans should be available by early to mid-April. The loans are available through and including June 30, 2020. Because many businesses have already laid off workers as a response to the pandemic, the program can be retroactive from February 15, 2020 to June 30, 2020, which allows previously laid off or furloughed employees to be returned to payrolls. Once the loan application process is implemented, the SBA plans to have lenders disburse loans in as few as 3 to 5 days.

Where are Paycheck Protection Applications Submitted?

Borrowers can apply for a Paycheck Protection Program loan at any financial institution that has partnered with the SBA. Additional guidance regarding how to apply for program loans, including how to find a qualified lender, is expected from the SBA by early to mid-April. Small Business owners are encouraged to contact the bank they currently use, or a nearby bank, to see if they will be participating in the Paycheck Protection Program.

What is the Maximum Loan Amount?

A business may borrow an amount equal to two and half times (2.5x) its average monthly “Payroll Costs”, not to exceed $10M dollars. Monthly Payroll Costs are calculated by taking the average total monthly payroll costs incurred during the 1-year period before the date on which the loan is made. “Payroll Costs” include the cumulative amount of wages, commissions, salary or similar compensation to an employee or independent contractor; payment of a cash tip or equivalent; payment for vacation, parental, family, medical or sick leave; allowance for dismissal or separation; payment for group health care benefits, including premiums; payment of any retirement benefits; and payment of state or local tax assessed on the compensation of employees (collectively, “Payroll Costs”). Compensation paid to an employee or independent contractor in excess of an annualized amount of $100,000; payroll taxes; compensation of employees residing outside of the U.S.; and qualified sick leave wages under the Families First Coronavirus Response Act are not included in the calculation of Payroll Costs.

What can the Loan be Used for?

The Paycheck Protection Program loans can be used for Payroll Costs (as defined above); rent; interest payments on mortgages; utilities; and interest on other outstanding debt.

What are the Terms of a Paycheck Protection Program Loan?

Lenders are required to defer payments for a period between six-months and one-year on all principal and interest. Loans have a maximum maturity date of 10 years after the borrower applies for the loan forgiveness described below. Interest rates are capped at 4%. While no interest payments are required during the deferment period, interest will accrue on the loan from the day the loan is made.

Can the Paycheck Protection Program Loan be Forgiven?

The purpose of the Paycheck Protection Program is to help Small Businesses retain their employees at their current base pay. If a borrower keeps all of its employees, the cumulative amount of Payroll Costs, rent, utility payments and interest paid on mortgages on real or personal property during the eight-week period following origination of the loan will be forgiven (the “Forgivable Costs”). If a borrower lays off employees, the forgiveness will be reduced by the percent decrease in the number of employees.

The amount of loan forgiveness will be reduced by multiplying (1) the Forgivable Costs by (2) a fraction obtained by dividing; (a) the average number of full-time employees per month during the eight-week period following origination of the loan by (b), at the election of the borrower, one of the two following values: (i) the average number of full-time employees per month between February 15, 2019 and June 30, 2019; or (ii) the average number of full-time employees per month between January 1, 2020 and February 29, 2020. Employees terminated between February 15, 2020 and April 26, 2020, but rehired by June 30, 2020, qualify in the numerator so long as they are fully paid as if they weren’t terminated. A borrower will need to calculate its average number of full-time employees in both 2019 and between January 1, 2020 and February 29, 2020 to determine the most favorable result. Accordingly, if a borrower’s workforce is only 70% of the workforce during the applicable comparison period, then only 70% of the maximum expected forgiven amount qualifies for forgiveness. The forgiveness is also reduced by salary reductions greater than 25 percent of the total salary or wages during the most recent full quarter before the loan was advanced.

Is a Personal Guarantee or Collateral Required to Qualify?

Personal guarantees and collateral requirements are waived. Additionally, borrowers will pay no fees for the loans.

If you have applied for, or received an Economic Injury Disaster Loan (EIDL) before the Paycheck Protection Program became Available, will I be able to obtain a Paycheck Protection Program loan?

The Paycheck Protection Program loan under the CARES Act is different than the Economic Injury Disaster Loans (“EIDL”), also administered by the SBA.

For EIDL loans, qualifying borrowers may be eligible for a loan of up to $2 million to meet financial obligations and operating expenses due to the impact of COVID-19. EIDL loans are available to businesses with fewer than 500 employees that have been in continuous operations since January 31, 2020. EIDL loans carry an interest rate of up to 3.75% for companies, and up to 2.75% for non-profits. The maturity date for an EIDL loan is up to 30 years. To apply for the EIDL loan, a business must show that it has been adversely affected by COVID-10; hardship may be evidenced by certification alone. The SBA waives personal guarantees on EIDL loans less than $200,000.

Under the CARES Act, an “emergency grant” program was established that permits applicants of EIDL loans to request an advance of up to $10,000. Such advance must be disbursed by the SBA within 3 days after an application for an EIDL loan is submitted, subject to verification that the business is eligible such loan. Any amount under $10,000 need not be repaid, even if the applicant is later denied an EIDL loan following review of its application.

At the time of this writing, the SBA has not provided firm guidance on whether applicants can apply for both a Paycheck Protection Program loan and an EIDL loan, though it appears that a business is in-fact permitted to receive both a Paycheck Protection Program loan and an EIDL loan provided the funds are used for different purposes. It is clear that applicants may use a Payment Protection Program loan to refinance a prior EIDL loan.

Is Relief Available for Businesses with Pre-Existing SBA Loans?

Yes, the SBA will pay the principal, interest, and associated fees on certain pre-existing SBA loans for 6 months.

More information will be forthcoming.

Currently, the SBA is developing more information regarding the administration of Paycheck Protection Program loans. We will continue to provide developments and information as they arise. For additional guidance, you may also refer to the U.S. Small Business Administration web-site.

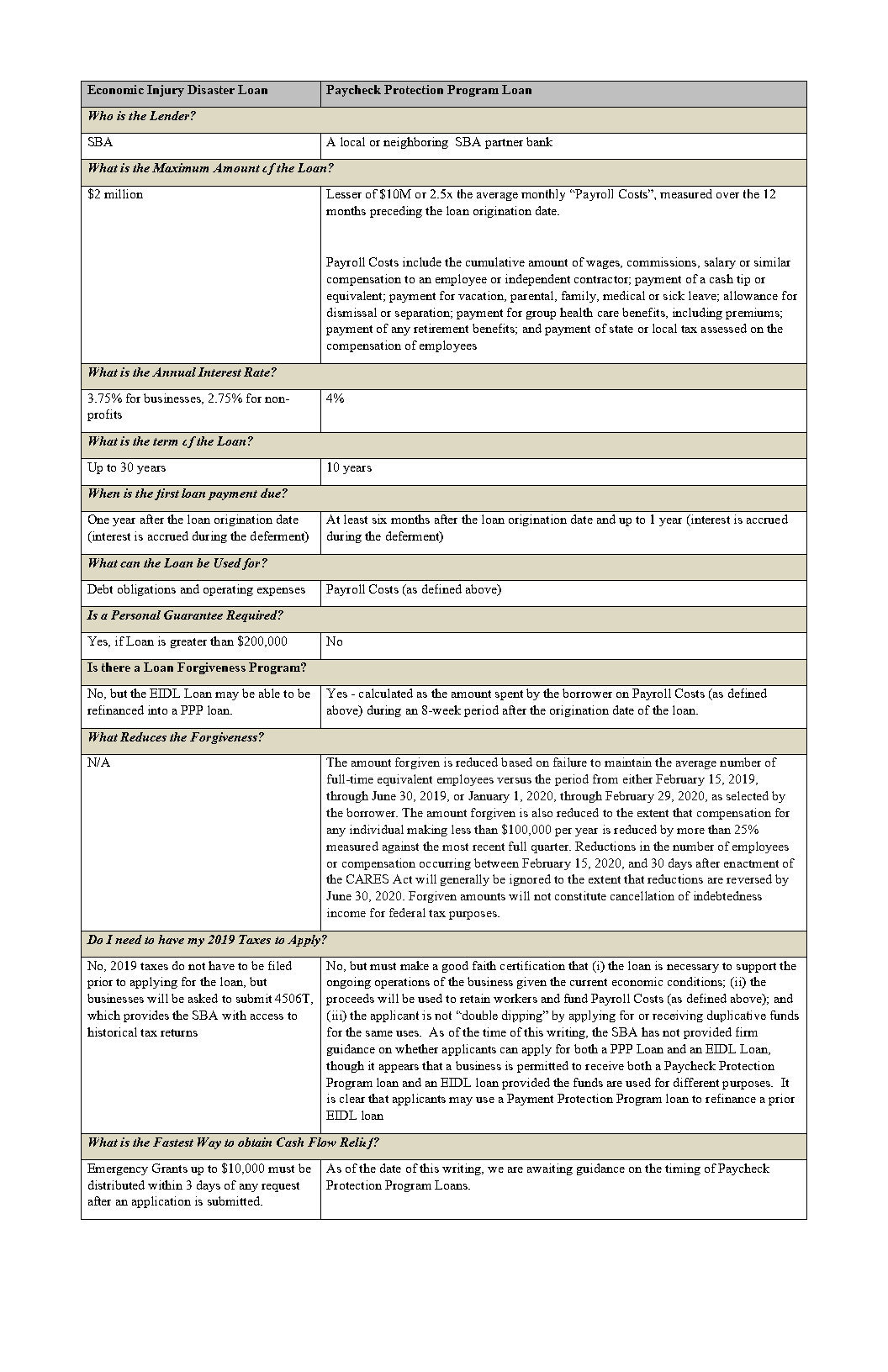

Below is a summary of some of the differences between an EIDL loan and a Paycheck Protection Program loan. This summary is not intended to be exhaustive of all of the differences between the loans.

Disclaimer: The information contained in this letter is provided for informational purposes only, and should not be construed as legal advice. Please call McNamee Hosea at 301-441-2420 if you wish to speak with an attorney about a legal matter.